AI, Analysis, Strategy: How CFI’s FPAP Certification Positions You as a Strategic Advisor in Finance

Master financial planning, advanced analysis, and accurate forecasting with CFI’s FPAP certification and become a strategic financial partner that organizations need.

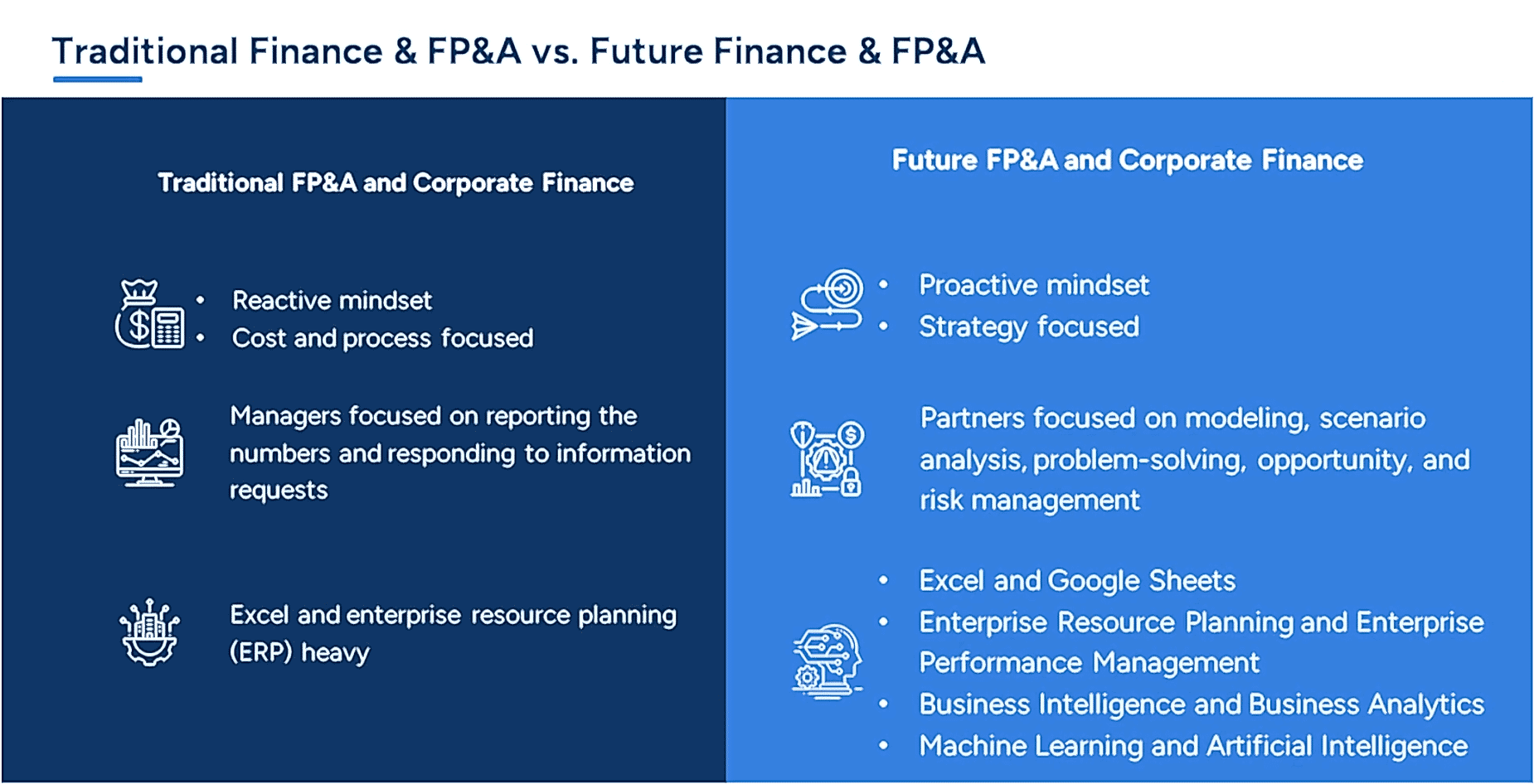

Finance is changing. Fast. Accounting or “crunching numbers” isn’t enough to get hired.

Companies need faster financial data processing with accurate forecasting. And they need someone who can turn numbers into strategic advice.

AI now handles the grunt work (data sheets formatting, data entry, basic calculations) that finance professionals used to do. Today, there’s a growing need for professionals who go beyond that and can analyze, evaluate, and use data for profitability.

You need to be able to mine data, read and understand data, understand statistical analysis techniques, and be able to communicate these to the required stakeholders for decision making. Your business and career depend on this.

– Forbes

Financial data analysis (including modeling) is one of the most in-demand skills for financial professionals, and a Financial Planning & Analysis Professional (FPAP) certification can become your entry point to becoming a strategic advisor.

But for employers to value your certification, it should be from a recognized and accredited platform. The FPAP certification by Corporate Finance Institute (CFI) is a leading program that is built to address the recent demand for analysis in finance.

Before we understand how the program does this, let’s understand the skills gap in finance that you can fill with the FPAP certification.

The Demand for Financial Data Analysis

The need for speed, accuracy, and critical thinking in finance is so critical that almost 60% of companies are considering the adoption of AI and machine learning technologies. In fact, 65% of companies that have adopted it are content with their forecasting capabilities.

This is why around 50% of CFOs highlight an acute need for financial planning and analysis (FP&A) expertise, not just basic accounting skills.

In response, the competition is rising too. Almost 78% of FP&A Professionals plan to improve technology and data skills this year to match industry demands.

According to Oracle, there are two main concerns that CFOs face today: enhancing financial planning and analysis (FP&A) and accelerating digital transformation. As an FP&A professional, you would be a strategic partner to an organization because you’ll resolve such business challenges.

Financial planning and analysis are not limited to budgeting and financial tracking. It’s a specialized role that goes deeper into modeling, advanced analysis, and strategic financial decision-making.

But how do you get ahead of the competition and secure a role in it? With a recognized, industry-standard certification.

With 67% leaders struggling to assess candidate qualifications, a certification can become an instant sign that you are worth interviewing. CFI offers this certification with practical skills that will make you job-ready.

Why Choose Corporate Finance Institute’s FPAP Certification?

Our aim is to empower our customers to conduct both quantitative and qualitative analyses, enabling them to evaluate a company’s financial progress. Participants will not only gain proficiency in Excel financial models but learn to leverage modern data tools like Power Query and Power BI, a skillset that is highly sought after in the industry.

– Scott Powell (Chief Content Officer, CFI)

The FPAP certification is a self-paced, 4-month-long program. It is detailed, comprehensive, and offers hands-on training in financial planning and data analysis.

If you’re an accountant or a financial reporter, this 60-100-hour program will transform you into a strategic advisor to businesses and position you as a problem solver.

This program is for you if you’re a:

- Current financial analyst seeking advanced skills in analysis and predictive modeling

- Finance student/new graduate/early-finance professional preparing for FP&A careers

- Accountant, analyst, or consultant transitioning to high-value, strategic finance roles like FP&A Manager and Project Evaluator

- Entrepreneurs/small business owners wanting to increase profits with strategic decisions

- Independent financial advisors/consultants working with businesses to boost their financial growth

Its 26,000 ratings with a 4.9 average are the result of:

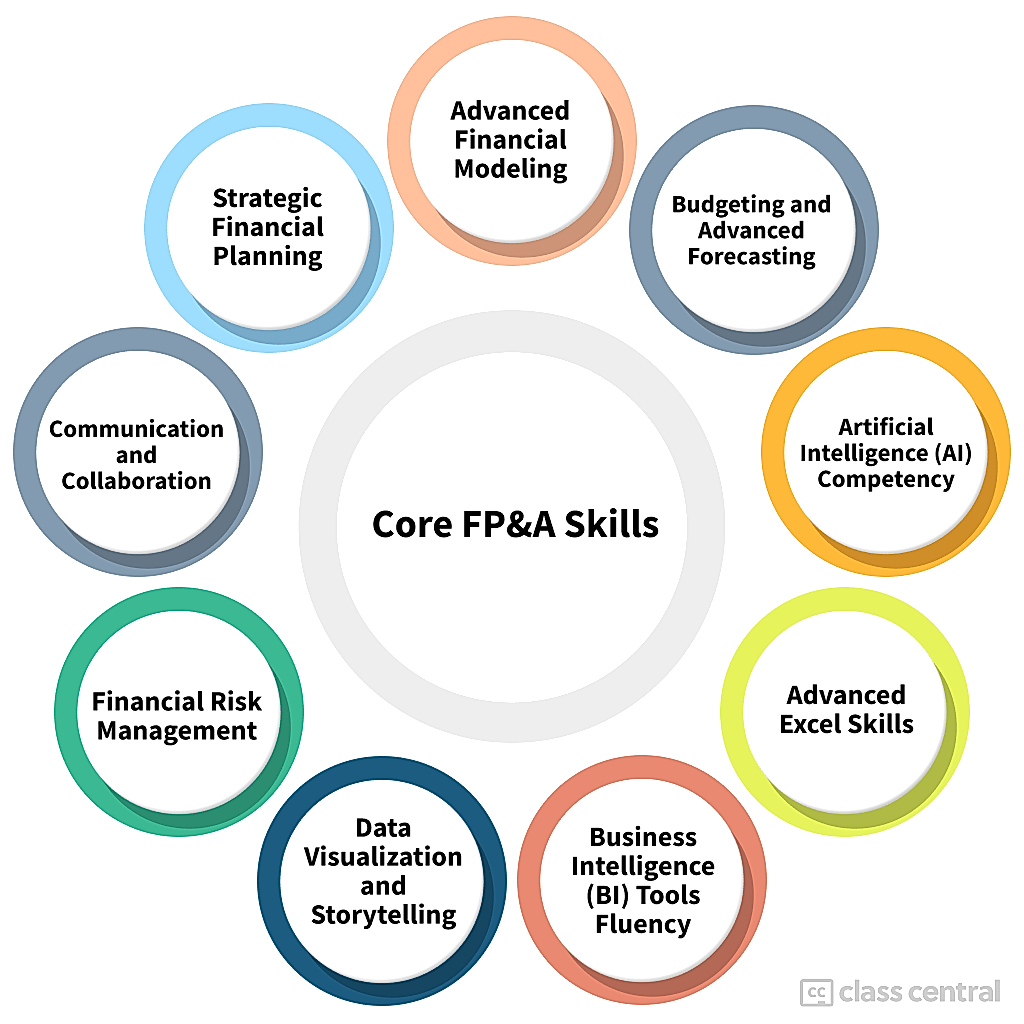

Industry-Demand Tech and Soft Skills

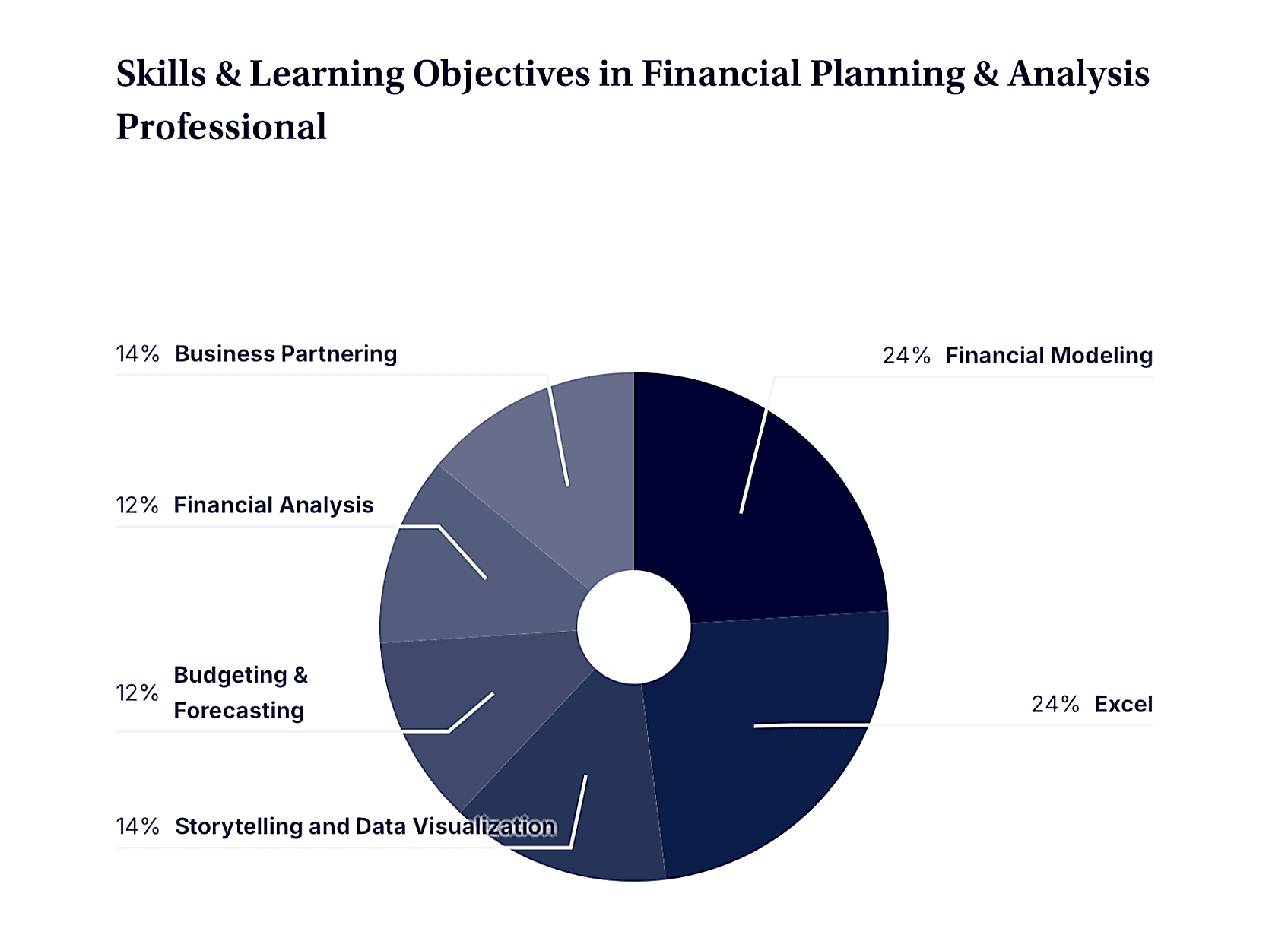

The program goes beyond the fundamentals of Excel and teaches you advanced formulas and shortcuts for quicker analysis. It also offers training in modern data tools like Power BI (for interactive and compelling data visualizations and storytelling) and Power Query (to process and clean data efficiently).

Side note: These tools will also give you an edge if you’re interviewing at companies that use Microsoft tools.

In terms of core finance skills, you’ll learn:

- Financial Modeling: Building FP&A models in Excel, managing monthly forecasts, and budgeting using advanced formulas and functions

- Financial Analysis: Leveraging FP&A templates to analyze monthly data, assessing year-over-year performance to identify trends and forecast timing, and conducting a comprehensive analysis with clear stakeholder-focused communication

- Budgeting and Forecasting: Creating accurate forecasts, analyzing budget variances, and using financial insights to improve future budgeting.

A proficiency in these skills will make you a better analyst, visualizer, and critical thinker.

The program also teaches you soft skills, the underrated drivers of your performance, such as ethics, decision-making, communication and presentation skills, and business partnering.

Overall, the program delivers practical skills that work from day one, regardless of your financial experience.

Intensive Curriculum

The FPAP program includes access to 40 courses (2070 lessons) and 160+ exercises, quizzes, and assessments (with guided simulations).

If you’re new to the financial analysis field, you can also choose among five prep courses that will warm you up for the main technical topics: Excel Fundamentals (Start Guide and Finance Formulas), Accounting Fundamentals, Introduction to 3-Statement Modeling, or Corporate Finance Fundamentals.

Then, you’ll move on to the 25 required courses that start by giving you an idea about the role of an FP&A professional. Then, it moves on to budgeting, modeling, variance, forecasting, visualization, and soft skills essential in FP&A.

You also get to choose electives (minimum three out of 10). These range from Power Query and Power BI fundamentals to AI-Powered Analysis.

The curriculum is designed to cover FP&A with industry-relevant and in-demand skills that will make you a complete analyst.

Globally-Accepted Certification

After you complete the courses, there is a final exam that requires a minimum passing grade of 70%. Once you achieve that, you receive a blockchain-verified certificate that is tamper-proof, trustworthy, and verified.

Over 75% of CFI learners report significant career advancement within months of program completion. One reason is the high employer recognition of the certification. CFI is accredited by the Better Business Bureau® (BBB), which ensures quality standards, the Chartered Professional Accountant (CPA) Institutions in Canada, and the National Association of State Boards of Accountancy (NASBA).

The other reason is what the certification denotes — hours of intense training, applicable skills that will lead to profitability, and the guidance of global finance leaders.

Due to these factors, the certification can qualify you for senior positions such as senior analyst and strategic finance roles (if you’re an existing finance professional).

Finance Leaders as Instructors

CFI’s expert faculty has been in the industry for years. They have watched it evolve, and with the rapid acceleration, they can predict its future needs.

The instructors offer you professional guidance on how to stand out, which skills to master, and the realities of the current state of the industry. Some instructors include:

- Tim Vipond: Co-founder and CEO of CFI Education with experience in entrepreneurship, financial analysis, and investment banking.

- Duncan McKeen: Executive Vice President of Financial Modeling at CFI, designing courses and teaching financial modeling since 2014 across accounting, valuation, investment banking, equity research, and private equity.

- Meeyeon Park: Expert in buy/sell-side of finance from her roles at Ontario Teachers Pension Plan in Fixed Income Portfolio Management and BMO Capital Markets in Investment Banking.

- Scott Powell: CFI’s Co-Founder with 30 years of experience designing learning solutions for financial services clients in commercial banking, investment banking, capital markets, and asset management.

- Glenn Hopper: Technology-minded CFO with over two decades of finance leadership experience and author of “Deep Finance: Corporate Finance in the Information Age”.

If you choose to learn under the guidance of an instructor (as opposed to self-study), you will receive personalized, 1-on-1 feedback and direction from these world-class instructors.

Flexible Learning Experience (for Self and Teams)

The 100% online FPAP certification is designed for busy professionals looking for an in-depth yet self-paced course.

What sets it apart is the choice between the learning plans. You can choose between two yearly plans that contain seven certifications, 200 courses, and access to downloadable resources:

- The Full-immersion Plan – With 24/7 AI support, 1-on-1 expert guidance sessions, and exclusive offers

- Self-Study Plan – With a relatively affordable fee, access to all materials, and standard support

| Feature | Self-Study Plan | Full-Immersion Plan |

| Productivity Templates | Unlimited download | Unlimited download |

| Course-integrated AI Chatbot | Not included | Included |

| 1-on-1 Guidance & Model Review | Not included | Included |

| Exclusive Partner Offers | Not included | Included |

| Expert Reviews & Support | Standard support | Priority/expert support |

| Target Learner | Independent/self-driven | Learners seeking expert guidance and more personalization |

Even if you choose the self-study plan and you’d like to resolve a doubt with an instructor, CFI helps you with it.

CFI also offers corporate training for teams, with the flexibility to customize programs based on specific organizational requirements and accommodations. If you’re a founder or a business owner who wants your finance team to upskill, you can reach out to CFI to certify your employees.

The Bottom Line of CFI’s FPAP Certification

CFI is an industry gold standard in financial certifications. Students have mentioned that after learning from CFI, their profiles have become more attractive and their confidence has increased.

In an industry that is quickly transforming and changing shape, and where competition is fierce, this certification will be an eye-catching feature in your resume. Plus, it’ll prepare you for your future role — not just as an accountant or analyst, but as a strategic financial advisor.

This article was produced by the Class Central Report team in partnership with the Corporate Finance Institute.